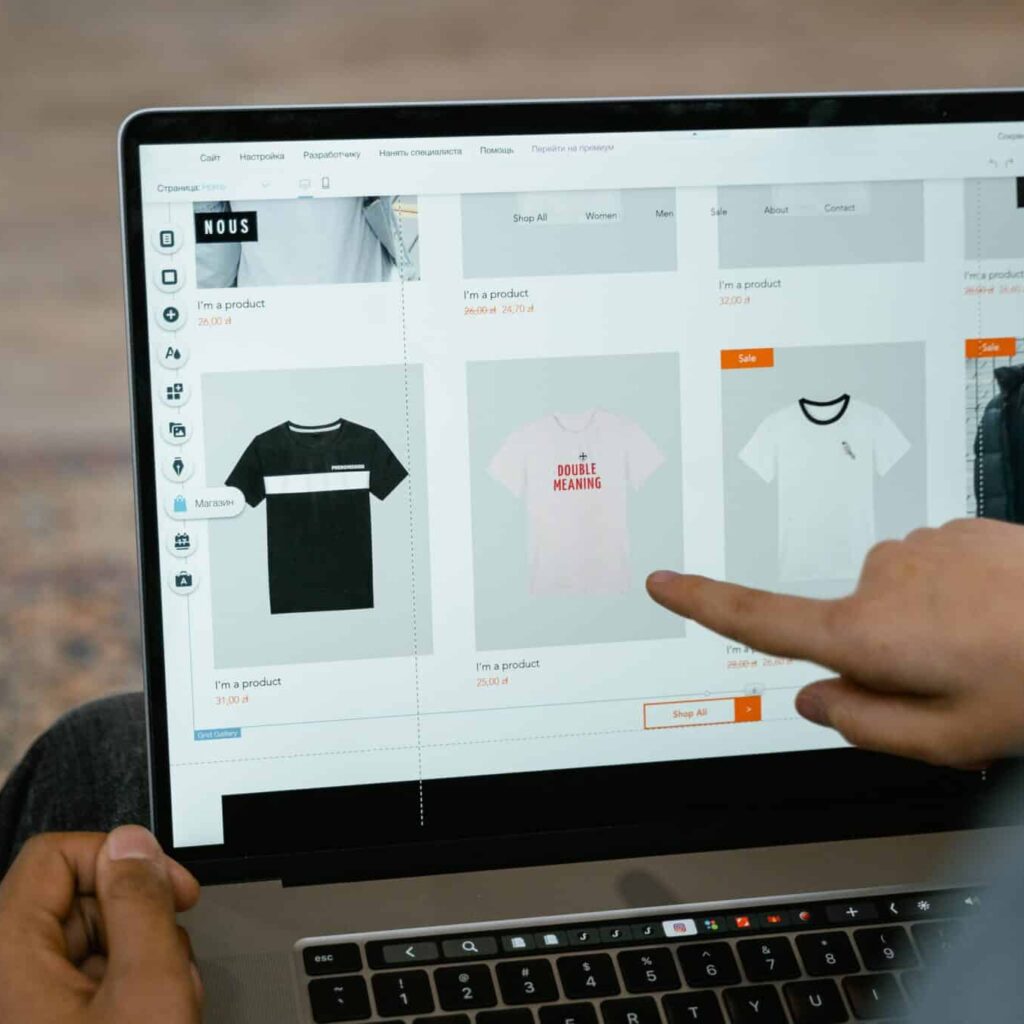

Sales taxes in the US is a common issue international entrepreneurs face when starting their own

e-commerce business in the country. Calculating tax rates and figuring out how to pay them to the tax agencies might seem an impossible task. But no worries, it’s not as difficult as it sounds. Anybody can comply with the law and run their business in the US from anywhere in the world.

Who has to pay sales taxes in the US?

Companies that sell physical products must include the sales tax rate on their products’ final price. In addition to that, they must collect the levy directly from their customers to pass it on to the state. This means that companies don’t pay them based on their profits. But rather receive it from their clients to then transfer it to the tax agencies in each state.

The rates vary depending on the state you register your company and the type of business you’re conducting. This is known as sales tax sourcing.

What is sales tax sourcing and how does it work?

Each state determines the sales taxes. Sellers check where they are based and where are they selling their products (can be retail or e-commerce).

There are US states that charge them based on the origin of the sale. However, others do so based on the destination.

If you registered your company in a destination-based state, the rate you will charge to your final customer will depend on their location. For example, Florida is a destination-based stat. If you sell from Florida to somebody in Georgia, the sales tax rate applied to the final price should be based on Georgia’s sales tax rates.

For origin-based states such as Arizona, the rate you will levy on your customers and then transfer to the state tax agency will always remain the same. This means that if you sell from origin-based Arizona to Florida, the rate to be applied will be Arizona’s.

For California, specifically, sales tax sourcing becomes trickier since every county has its own rates. Besides, the state has a destination-county-based policy.

How do I calculate these tax rates for my products?

Even though each state has its own rates and policies and things can get very confusing very quickly, the good news is that you have plenty of tools to help you with it.

Tools such as TaxJar automate the process of collecting tax sales for each sale and can be integrated into any retail system. You can even use it for both on-site and online sales.

Also, marketplaces such as Amazon and Etsy and payment processors like Stripe also offer automated US sales tax collection and compliance. You won’t have to worry about calculating the rates for each sale, but rather focus on expanding your business while these automated tools take care of the math.