All EIN applications must contain the name of a business director, partner, owner, or trustee. This person, whom the IRS will call the “Responsible Party,” controls, manages, or directs the applying business and the disposition of its funds and assets. In order to comply, each company must designate only one person that the entity wants the IRS to recognize as the Responsible Party for an US company. Additionally, entities must report any changes to the responsible party to the IRS within 60 days, using form 8822-B. Although if you open your business with Globalfy, you won’t have to worry about filling any form.

What is the IRS definition of Responsible Party for a US company?

The IRS defines the “Responsible Party” for a US company as the person who has control over a company’s financial resources and assets, which means they have the power to direct and manage the company’s funds and make important decisions about its assets. However, just owning the company or financing it is not enough to be considered a “Responsible Party.”

This person is responsible for ensuring that the company follows all tax laws and regulations. It’s important to correctly identify the “Responsible Party” when filing tax forms to avoid any legal issues or penalties.

What happens if the person responsible for the company does not have an ITIN or SSN?

In this case, when requesting the EIN, it will be indicated that the person responsible is a foreigner.

If the assigned person no longer has control over the company, what should be done?

If the person listed as the Responsible Party for a US company no longer has control over the business, they must complete Form 8822-B and submit it to the IRS within 60 days stating that they are the new Responsible Party.

Now, if you don’t want to worry about any of this, consult the Globalfy business formation plan. You’ll get:

- Forming an LLC or Corp in the US online

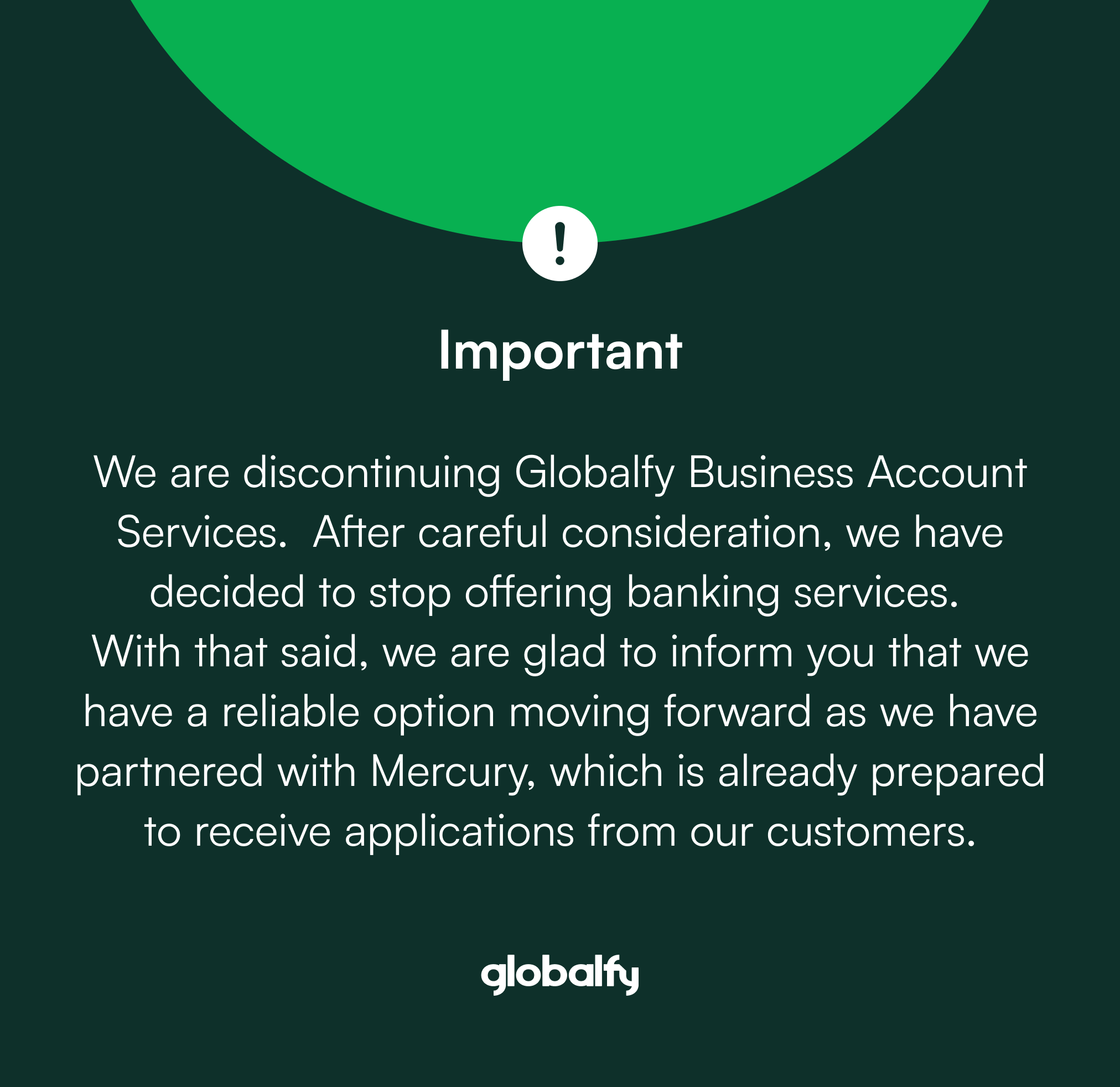

- An American business bank account

- A Registered Agent for one year to take care of your business commitments

- Virtual US address for your company

- Over US$200,000 in discounts on platforms such as Google Ads, Hubspot, Stripe, etc.

- Start now and forget about the bureaucracy and focus on generating profits.