Delaware is one of the biggest tax havens in the United States, counting on more registered private businesses than inhabitants. Tech entrepreneurs from all over the world see the US, and especially the state of Delaware as the best option to expand their operations and grow their businesses. Now, let’s see how you can enjoy all these benefits and how to set up an offshore company in Delaware as a non-resident tech business founder.

Keep reading and you’ll find the requirements, paperwork, and more to establish your offshore company in Delaware without even setting foot in the United States.

What is an offshore company?

An offshore company is any business incorporated in a territory or jurisdiction where its owners do not reside. It can also be any company that operates in a country or state different from the one it has been registered in.

In the case of Delaware, the state is regarded as a tax haven by entrepreneurs and business experts all around the world, although it is not included in the Organisation for Economic Co-operation and Development uncooperative tax havens list.

Thousands of international business founders go to Delaware every year to establish their operations in the US and enjoy the perks of setting up an offshore business in the state.

What are the benefits of setting up an offshore company in Delaware

Opening up an offshore company in Delaware has many advantages in comparison to other US states. Now, let’s take a look at the best benefits it can offer to foreign entrepreneurs.

- You can open either a C Corp or an LLC without any more partners or owners. It’s called single-member LLC o single-shareholder Corp and foreigners are welcome to do so in Delaware.

- You can open your company in Delaware but you’re not obligated to have an office in the state. By having your business registered in Delaware and basing your operations elsewhere outside the US you won’t have to pay any State Corporate Income Tax.

- Delaware LLCs owned by non-US residents pay no Federal Income Tax if the income source is from outside the United States (must fill out the 5472 form to inform the IRS anyways).

- Delaware companies don’t have to disclose information on their owners or their accounting to the public. By setting up an offshore company in Delaware you’ll be granted privacy.

- By opening your offshore company in Delaware with Globalfy, you’ll be able to do business in the US in as little as 4 business weeks.

Delaware also has an offshore company friendliness tradition. The Delaware General Corporation Law highly favors both domestic and international entrepreneurs, granting very few benefits for creditors when it comes to asset claims.

Under what conditions is it best to set up an offshore company in Delaware?

The best way to set up an offshore company in Delaware is by establishing a business that can conduct activities online or at least outside of the US. Because of this, SaaS startups, e-commerce businesses, consulting agencies, and import-export companies are the most popular in Delaware.

The state laws and tax regulations are designed to attract foreign capital and protect offshore tech companies. Delaware welcomes online entrepreneurs and allows them to set up companies without having to set foot in the state. In addition to this, with Globalfy’s all-in-one business formation plan, you’ll be able to set up an offshore company in Delaware 100% remotely, without having to leave your home country.

If you are to conduct business in other areas and are wondering how to set up an offshore company in Delaware, you’d better double-check some facts. Some industries are more scrutinized by American and other national agencies. So much so that even including certain words in the name of your company can flag your business, e.g. “bank”, “insurance”, “trust”, “school”, or “university”.

You’ll also need to make sure to have your tax fillings up-to-date in your tax-home country. National tax agencies inform each other of suspicious invoicing and physical goods purchases.

How to set up an offshore company in Delaware online

Let’s see the step-by-step to form a business in Delaware as a foreigner.

- Choose your corporate structure: as a foreign entrepreneur you can choose to form either an LLC or a C Corp in Delaware. LLCs are more popular for setting up offshore a company since they have wider personal liability protection.

- Register your company in the state: submit the paperwork with your personal and business information and pay the Delaware business fee (minimum US$89 for Corps and minimum US$90 for LLCs).

- Get your EIN: submit your registration documents to the IRS and obtain your Employer Identification Number. This is vital to operate in the US and pay taxes (or claim tax exemptions).

- Hire a Registered Agent: hire a state-sanctioned professional or company to keep you informed and updated about your company’s legal obligations.

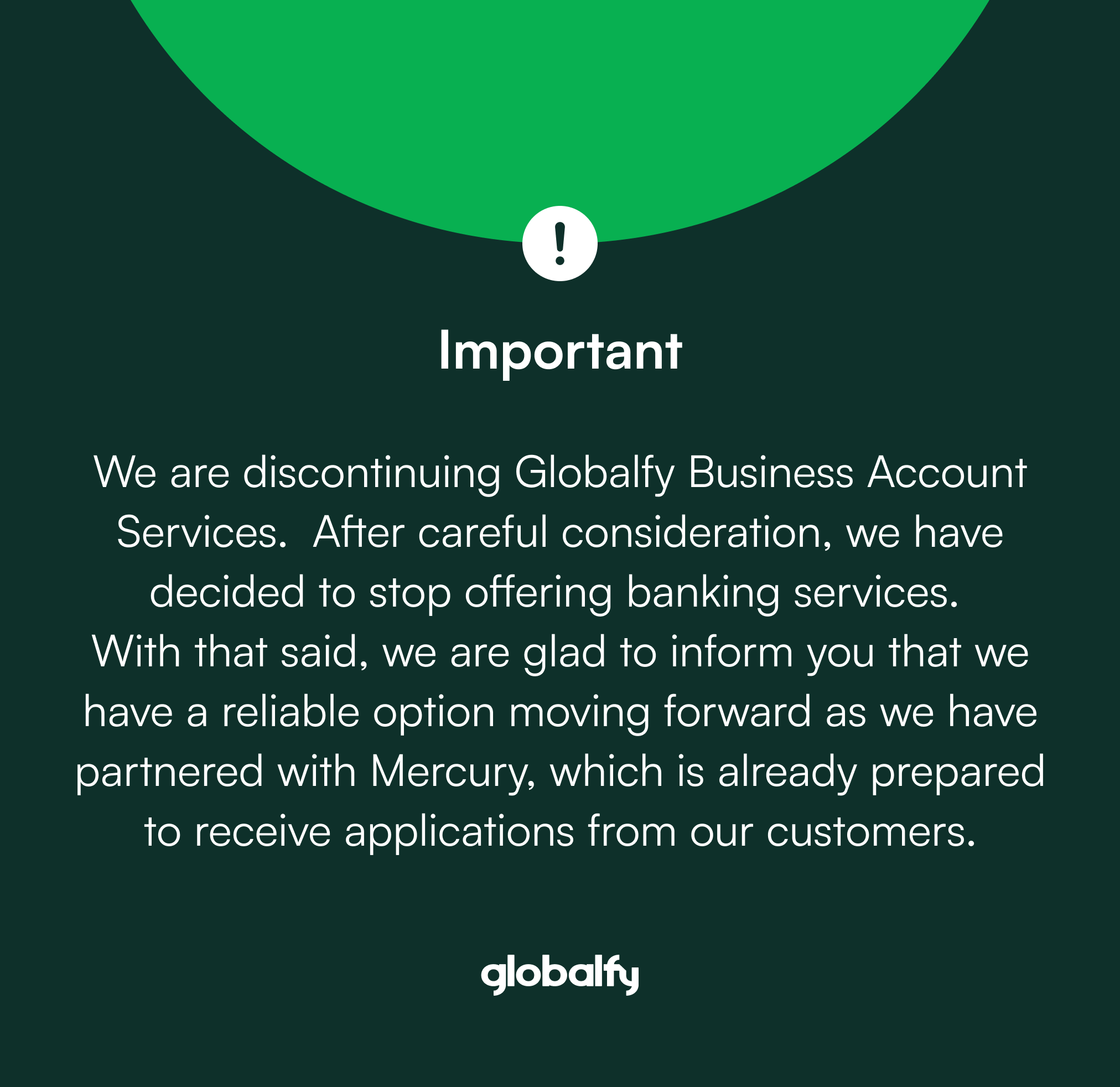

- Open your US business bank account: With Globalfy’s business formation plan, you get a American bank account and a Visa debit card for your business.

With Globalfy’s all-in-one business plan you’ll be able to get all this paperwork done with just one click. Pay US$599 (plus the state formation fee) and enjoy all the benefits of setting up an offshore company in Delaware. Plus, get 1 year of Registered Agent, 1 year of Virtual Address, and a US business bank account.

Now that you have all the details on how to set up an offshore company in Delaware, just click here and open your US business online.

4 Responses

i am resident indian. I have a global legal advisory service and also earn comission for structuring international trade deals. I expect annual turnover to be approximately 250 to 300 thousand usd.

I will need a off shore company with 0 tax liability and a bank account with remote ie net based access.

I am indian tax payer and citizen.

Please suggest appropriate structure intial fees and annual charges to me.

Also indicate which bank you will setup account. I would prefer an international american bank such as Citi but that is not critical.

Hello Abhaya,

Thank you for the comment.

Please reach out to our experts. We have a teaqm ready to solve your doubts: https://globalfy.com/en/talk-to-sales/

Best Regards,

Team Globalfy

Could a USA citizen open an offshore account in Delaware?

Hi Elias!

Thank you for your question.

Please get in touch with our Help Center team: https://help.globalfy.com/hc/en-us

Best regards,

Globalfy Team