Content updated in January 2024

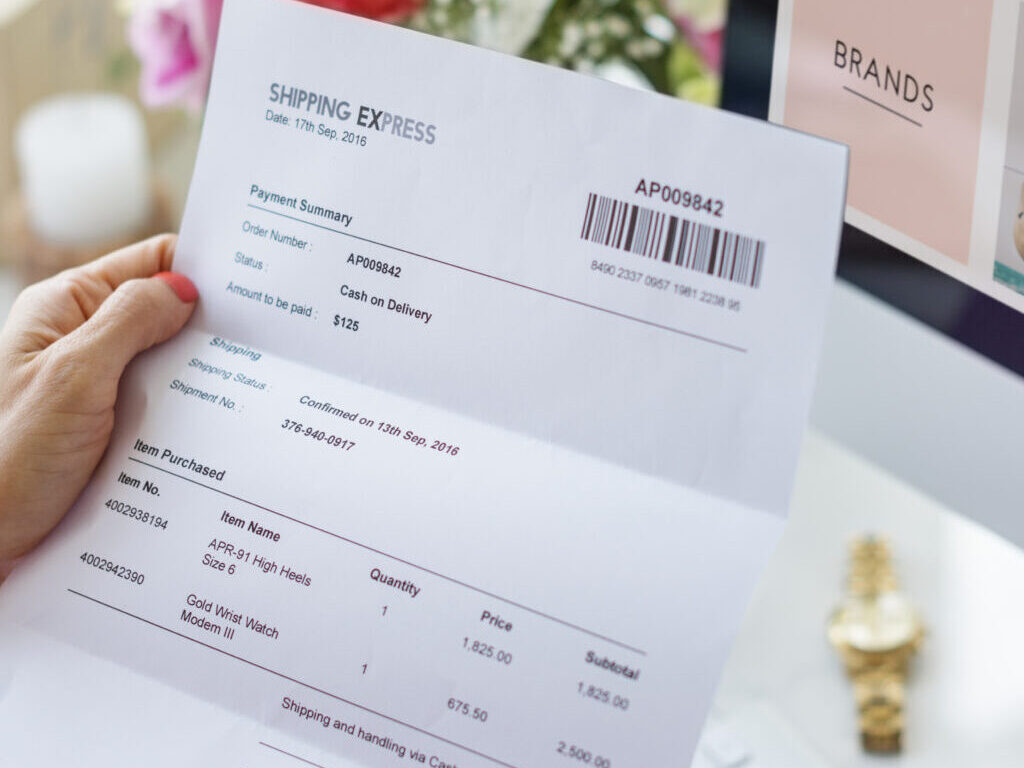

An invoice is a financial description of the products or services provided to a customer and the corresponding payment due. Understanding how this document works and what you need to issue an invoice is crucial for anyone planning to do business overseas.

Many business owners who opt for expanding their operations globally encounter difficulties controlling their finances. Learning how to issue an invoice is one of the first steps toward the financial health of their companies. Keep reading to find out more about these documents and how to keep track of your finances in the US.

What is an invoice?

When a buyer makes a purchase or receives a service from a seller or provider, they will receive an invoice. This document includes all the relevant details of the transaction, such as the items purchased and their respective prices. Additionally, it may contain information regarding payment, such as the accepted methods and terms.

Besides keeping track of sales, invoices can be useful for legal protection sellers’ and buyers’ legal protection, and they encourage timely payments. These documents contain essential information such as the date of sale, the purchaser, and the recipient. They serve as a reliable and convenient reference point for all parties involved.

How to issue an invoice?

Now you know what an invoice is. Therefore, the next step is to issue one. The document is simple, and it can be generated with the help of accessible tools, for example, Word or Google Docs. Just look for a model as a reference in a quick search on the Internet, and use it as a basis to issue your invoice.

Some programs facilitate the process, such as Invoice Generator. After filling in the required information, such as your company name, date, and amount, it is ready.

Despite the ease, be aware of your company’s accounting control. After all, you are responsible for issuing invoices and all your company’s other financial transactions.

Bookkeeping and finances in the US

In other countries, you must have an accountant dedicated to your business, while in the United States, the entrepreneur can choose whether he wants to hire this service.

Even though it is optional, it is recommended to count on the support of a professional team, which will help fulfill your company’s accounting and tax obligations. Considering that you will be doing business in a new country, having specialized partners to help you on your journey is very important.

When it comes to your company’s management and accounting control, it is worth relying on professional support or even software. There are several options, such as Quickbooks, Freshbooks, and Xero.

At Globalfy, we have opted for Xero. We recommend this software to all our customers and partners. It facilitates the issuance of personalized invoices and ensures control over your billing and payment history.

What is Xero?

Xero was founded in 2006 in New Zealand and has more than 1 million customers in four major markets: New Zealand, Australia, the United Kingdom, and the United States. With more than 1,200 employees, it offers local solutions for each market in which it operates. The platform is online and has the advantage of being very intuitive, which makes it much easier for new users!

Regarding the options to issue an invoice, Xero provides a module in which you can automatically send the document to your customer’s email. At the same time, you can get your payment through Paypal or Stripe. There is even the possibility of automating the creation of invoices for recurring payments and programming the system to send automatic alerts and reminders close to its due date.

It also makes it possible to register clients and maintain control over their main information, such as revenue and contact data. Another great feature s that you can integrate your system with CRM and email marketing tools.

Issue an invoice: tips on financial control

One of the main reasons entrepreneurs should learn to correctly issue an invoice is the importance of maintaining financial control. Also known as accounts payable and accounts receivable, it is a key point for your business.

Xero can be a great ally in reporting and keeping track of your finances. In this area, you can monitor your company’s financial health, create personalized reports, and use its mobile application to access information easily.

The integration of the financial area with other modules, such as invoices, is a strength of the system. It allows the analysis of revenue versus cost per project with the possibility of controlling future revenues.

It is worth remembering that it is possible to control your team through Xero, as well as your inventory. With the payroll model (Payroll) available in the software, you can completely control your staff, and calculate and collect taxes. On the other hand, inventory control is integrated with your invoices and the accounting module.

Take care of your finances in one place!

Here at Globalfy, we offer accounting services in the USA with the support of Xero. The software allows the client’s bank account to be integrated into its system, so our team of bookkeepers can take care of the monthly accounting classification of entries. That way, you can track reports online, access your accumulated profit, and still manage to predict your annual taxes. For more information, contact us!

2 Responses

llenado forma W9 (SP) para cobro de nuestra 1er factura ayuda urgente

Hola, Filiberto. ¿Como estas?

Gracias por tu comentario.

Alguien de nuestro equipo se pondrá en contacto contigo lo antes posible para ayudarte a resolver la situación.

Saludos,

Equipo Globalfy