Entrepreneurs are always coming up with new ideas and projects. That’s why it is important to know how to efficiently run more than one business when expanding to the US. Since a Limited Liability Company (LLC) is one of the most popular company structures in the US, one of the questions that come up a lot for foreign founders is “Can an LLC own another LLC?” and “How to operate these companies?”.

Keep reading to find all the information you need to work as a holding company in the US.

Can an LLC own another LLC?

The short answer to the question “Can an LLC own another LLC?” is yes! According to regulations, LLC members can be individuals or even other entities. You can also form a single-member LLC with another company as its sole owner.

In these cases, the owner LLC, known as a holding company, owns a controlling interest in other companies, called subsidiaries. The holding company can, in fact, own multiple businesses.

It is important to remember that each LLC must be maintained independently of the other. For example, you should have separate business bank accounts, maintain individual financial records, and make sure that each entity has its own governance rules.

What is a Holding Company?

Holding companies operate with the primary purpose of controlling other entities. This kind of company doesn’t manufacture, sell products, or provide services. A holding LLC can also own real estate, trademarks, stocks, and other properties.

The main goal of a parent company is to establish a corporate group and streamline the management of multiple companies. Even though the holding company doesn’t control the day-to-day operations of its subsidiaries, it has some managerial control. The holding LLC can make decisions such as electing a board of directors and merging the subsidiary.

All you need to be a holding company is to open your business in the US and acquire shares or equity in another company. You could also form a new LLC, which can be done from anywhere in the world with the help of Globalfy. Open your business online today and start your own holding company.

This structure helps to protect the master entity and its subsidiaries financially and legally. It can also reduce the business’ overall taxes by basing parts of it in states with lower tax rates.

Should my LLC own another LLC?

Usually, most people think of holding companies as giant corporations — such as Alphabet, Google’s parent company — but this structure can propel businesses of all sizes. For foreign entrepreneurs thinking if their LLC can own another LLC, this structure can be helpful when operating more than one business in the US.

Advantages of a holding LLC

Protection

Owning an LLC is already a way to protect your personal and business assets. This structure protects you if your company faces any legal burden.

By placing your operating companies as subsidiaries, you add another layer of protection to guarantee each entity will be responsible for its losses. This will ensure that your company’s assets are protected in case one of your subsidiaries goes bankrupt or faces legal prosecution. The holding company may deal with capital loss, however, it cannot be charged for its subsidiary’s debt.

Financial Strength

Parent companies can help improve the subsidiary’s financial strength. It’s easier for companies to take loans and get investments when they have a holding company’s support.

Foreign entrepreneurs can also make the most of their LLCs by centering some administrative services in the parent company. Shared resources, like marketing expenses, make the cost of operations lower.

Taxation

One of the advantages of operating as a holding company is the tax benefits. As LLCs are pass-through entities, the profit and losses from all subsidiaries will be taxed under the ultimate owner Tax Return. In this case, if some activities have a loss, it will offset the profits from the others, reducing the overall taxes. Another benefit is, as a foreign entrepreneur in the US, you can operate in states that offer friendly tax regulations for your practice.

Disadvantages of owning an LLC within another LLC

Even though operating your business as a holding company can be convenient, to ensure that your LLC can own another LLC you need to consider the detriment it can cause to your operation. One of the biggest challenges is the management of a corporate group. For international founders, overseeing this kind of operation can be extremely difficult. Every LLC must maintain its own records, bank accounts, tax documents, and payroll.

Find out how you can make your LLC a holding company below.

How can an LLC own another LLC?

An LLC can become a holding company by acquiring shares or equity in other businesses or even opening a new company. The process to make your LLC a business holding company is as simple as opening a new company.

Get to know the steps to start your LLC:

- Choose the best state to register your company. As an entrepreneur, you need to know the states that could work better with your operations. Every state has different tax regulations and fees to open your LLC.

- Get a Registered Agent. This is the person or entity that will keep your business’s documents in order and make sure you’re aware of any legal or fiscal obligations.

- Inform an address. To submit your business formation documentation to the state, you’ll need a US address. If you don’t have one, you can get a Virtual Address with Globalfy.

- Submit Articles of Organization and Operating Agreement. These documents contain all your company’s information. When signing these documents for subsidiary companies, you should make sure to fill out your Holding LLC as a member.

- Obtain your EIN. To pay your taxes and hire employees in the US, you’ll need an Employer Identification Number (EIN.) You aren’t required to have a Social Security Number or Individual Taxpayer Identification Number (ITIN) to obtain an EIN.

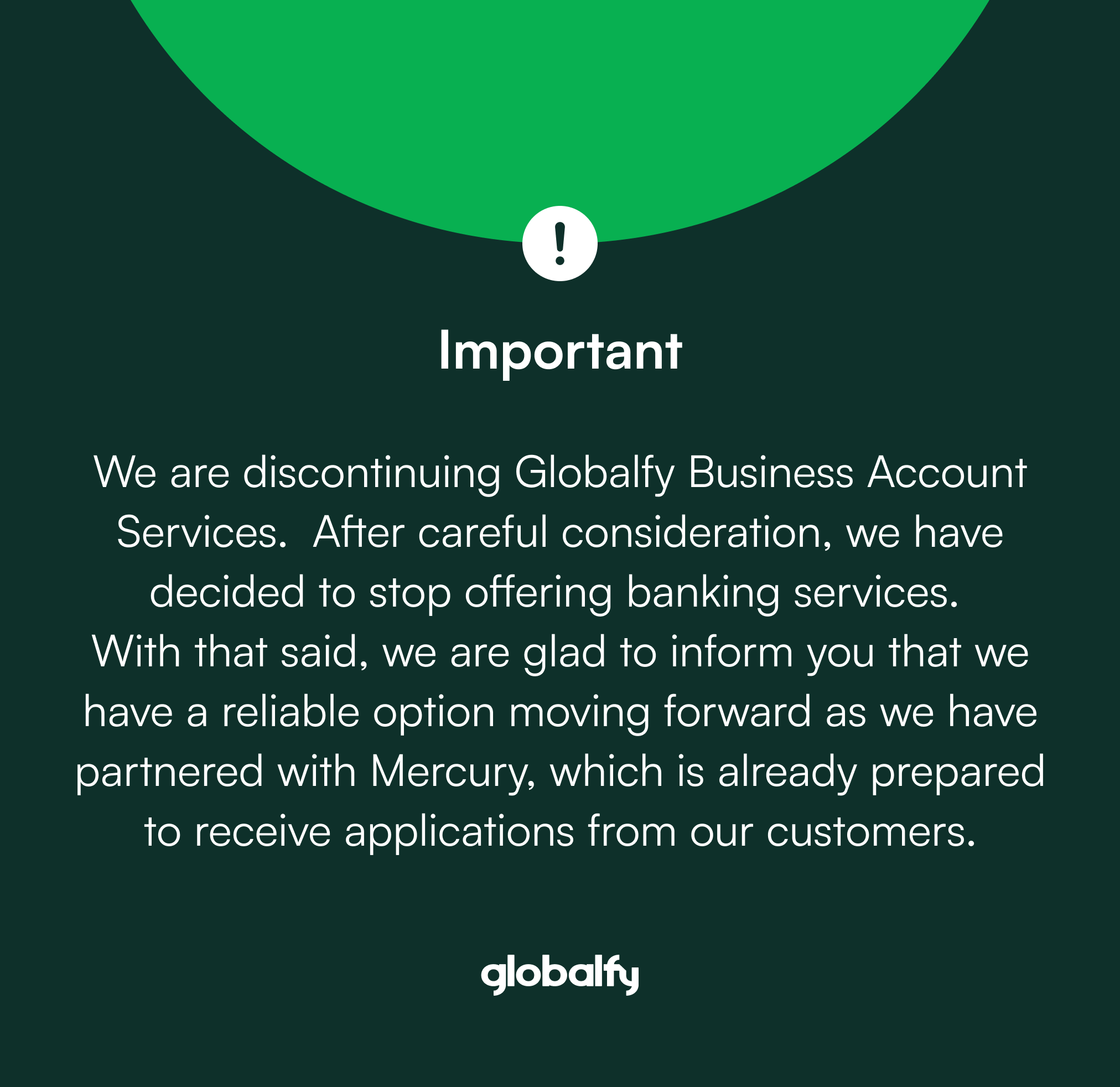

- Open a US business bank account. With Globalfy, you can get a US bank account to manage each of your LLC’s finances. A US business bank account is also necessary for bookkeeping and tax purposes.

This process may seem challenging, but it’s getting easier and easier! With the help of companies like Globalfy, you can open an LLC and its subsidiaries from anywhere in the world.

Our all-in-one plan includes 1 year of Virtual Address and Registered Agent service, a US bank account for your business, and more. All of this for just $599. Do not miss out on this opportunity and expand your business horizons!

2 Responses

My wife and I have recently established an LLC in California. We are currently exploring the possibility of starting a holding company LLC in Maryland.

Hello, Vansin. How are you?

Thank you for your comment.

Please reach out to our team of experts: https://globalfy.com/en/talk-to-sales/

They will be happy to assist you.

Best regards,

Globalfy team