Do you know how to open a business bank account in the U.S.? Having a global company that operates in several countries worldwide is a reality for many entrepreneurs. To participate in the global market, it is necessary to complete a few steps and formalize your company, including having a bank account to carry out your business’s financial transactions. Here, we will cover what you need to know about this process.

Starting a business in the United States is the first step to conquering the global market and having a worldwide business. Contrary to what many people believe, the process of opening a company in the U.S. is relatively simple, and the formalization can be completed in just a few steps.

To operate in the country, you need to have an EIN (Employer Identification Number). During the process, you will need to choose a state to register your company, decide if you prefer the LLC or the CORP model, and contract a virtual address to receive your mail. Finally, you will need to open your business bank account.

Opening a bank account can cause some doubts or even delay the start of your business operations. This is because many traditional U.S. banks do not have a foreigner-friendly process, and often it is necessary to go to the branch in person to complete the opening.

This can represent a difficulty for foreign entrepreneurs since it is not always possible to travel to the country. In addition, the documentation required by traditional banks can also represent a barrier.

What documents are required in traditional American banks?

The processes may vary from one bank to another, but some specific documents are generally required when opening a business bank account in the US. They include the following:

- U.S. driver’s license or SSN (Social Security Number)

- Proof of address in the country

- Initial deposit

The requirement of documents such as an SSN and the need to go to the bank branch to complete the opening process can make it difficult for foreign entrepreneurs. This is why digital banks and fintech have gained prominence in the banking market.

Today, there are already companies that allow you to open a business bank account remotely and with the use of a passport.

How can Globalfy help in the process of obtaining a business bank account in the US for non-resident entrepreneurs?

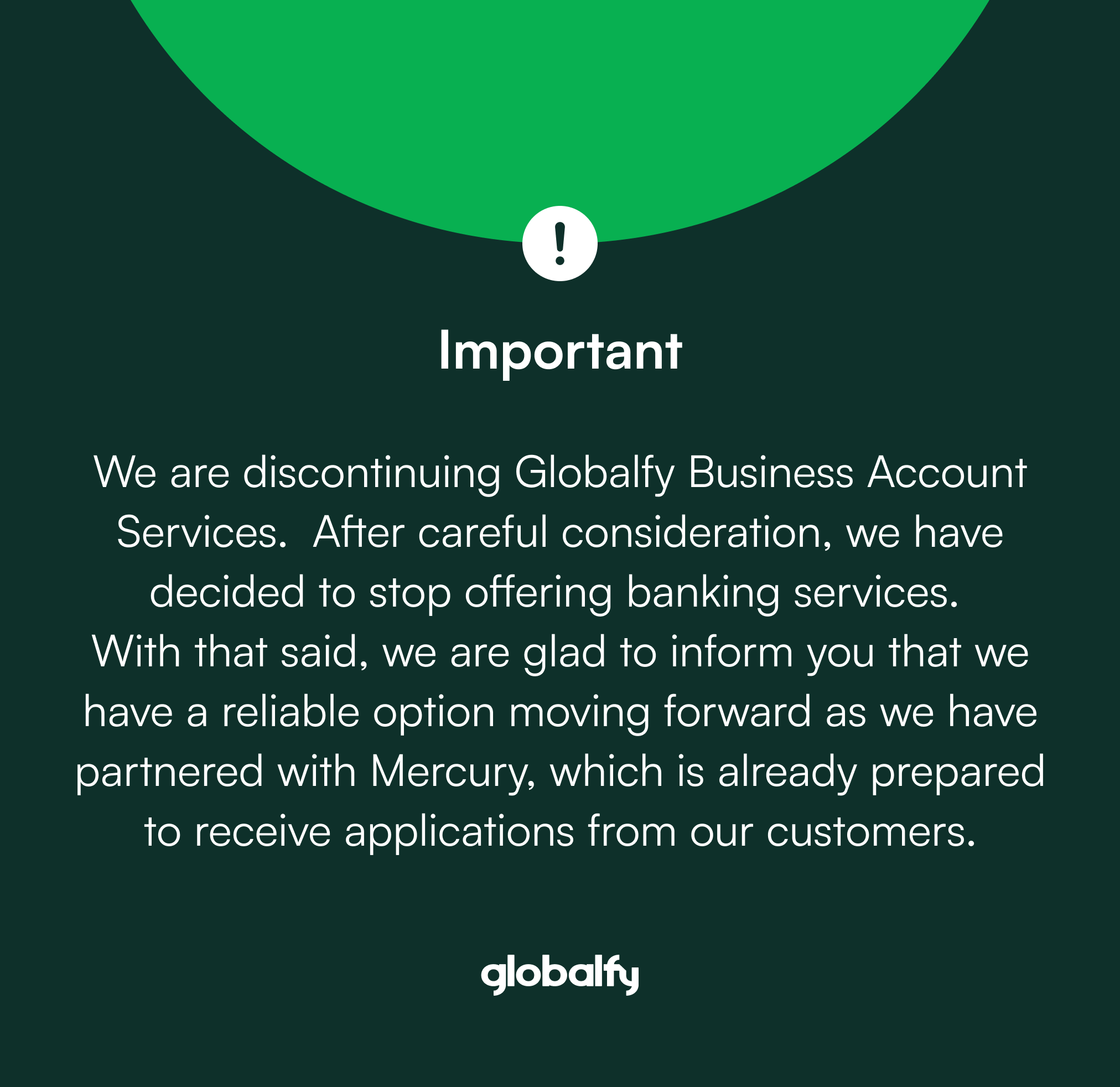

Globalfy was created to help entrepreneurs expand their businesses to the United States. It was developed for foreign entrepreneurs. The idea is to facilitate the company creation process for entrepreneurs outside the U.S. who often find it challenging to start their business in the country. Therefore, although we do not offer business bank account in the US services, we know how the ecosystem can develop and we can support you. Learn what the step-by-step process is like at Globalfy!

Keep in mind that banks facilitate the opening process when an American company is involved. We help you to make sure that your new US company is well established and that all the paperwork is in order, so that applying for the bank account is much easier.

What documents are required for a business bank account in the US?

Usually, to open your banking account with a fintech, all you need is an established U.S. company (LLC or CORP) and to provide your state registration document, EIN letter, U.S. address, and a valid passport. This way, you complete the process without the need to submit a SSN or ITIN.

With the process of opening your business, you will have all these documents in hand. If you do not yet have your business formalized in the country, you can count on the support of companies that do this procedure, such as Globalfy.

Do I need to travel to the United States?

You do not need to be in the United States to open your american business with Globalfy. We are a digital solution, and the entire process is done online and directly from the website. About the banking account, if you choose one of the new digital solutions available, you won’t have to travel either.

Do neobanks cater to all industries?

Usually, they provide banking services for startups, digital businesses, e-commerce, and direct-to-consumer (D2C) brands. They also help startups, SaaS, technology service providers, marketing service providers, freelancers, online services, and digital assets. This is in addition to companies established to manage investments in the U.S. stock market. Some banking institutions avoid certain sectors in order to remain in compliance.

Open your business in the U.S. and participate in the American market

You can also participate in the U.S. market and expand your operations globally! If you have not yet started the process of expanding your business, open your US company now!