Your company was born to be #global

An all-in-one platform to simplify doing business in the US: open, manage, and expand to the American market from anywhere

Want to start a business in the US?

made for SMBsfreelancersdeveloperstechnologye-commercedigital servicessolo entrepreneurs

made for SMBsfreelancersdeveloperstechnologye-commercedigital servicessolo entrepreneurs

All our plans have the services you need:

- Company Registration (LLC or Corp)

- EIN Application with the IRS

- Post-Formation Documents Templates

- Updates for existing companies

- Registered Agent

- Virtual Address

- Compliance Calendar

- Beneficial Ownership Information Reporting (BOI)

Three steps you must take to conquer the US market hassle-free

We offer you the opportunity to register your company in five different states: Delaware, Wyoming, New Mexico, Texas or Florida.

Each one has different advantages to benefit your business!

It is important to choose the right type of corporate structure, such as LLC or C Corp, for your business. This will help you avoid legal issues and make the most of investment opportunities.

Learn about the advantages of each structure.

Each plan was designed to facilitate different stages of your journey as an entrepreneur in the USA.

From formation to business success, we will support you with the bureaucracy.

We speak your language

Count on our specialized teams to assist you along the way, as we offer support in English, Portuguese, and Spanish. We are ready to help you through multiple channels like email, chat, and WhatsApp.

Get in touch with us:

we handle taxesbookkeepingbureaucracies

we handle taxesbookkeepingbureaucracies

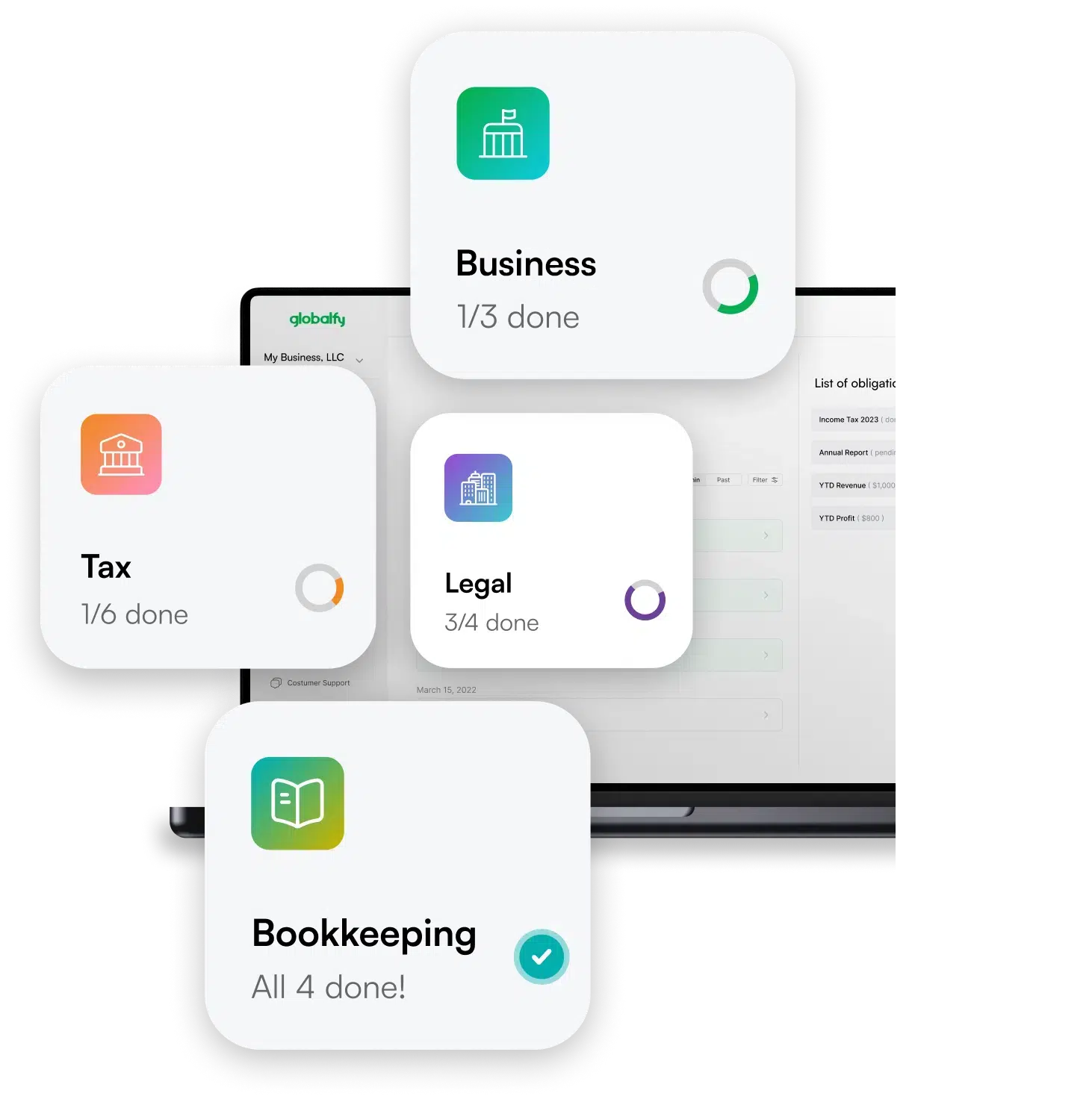

Keep track of your earnings and optimize your profits all in one place

Our tools help you manage your finances easily from start to finish. We combine accounting, tax management, and business overview solutions into one place, so you don’t have to worry about keeping everything organized.

We’ll take care of your business’s financial health while you focus on making a profit in dollars!

Keep track of your earnings and optimize your profits all in one place

Our tools help you manage your finances easily from start to finish. We combine accounting, tax management, and business overview solutions into one place, so you don’t have to worry about keeping everything organized.

We’ll take care of your business’s financial health while you focus on making a profit in dollars!

Meet clients who unlocked their global potential with us

“The important thing is to find the right partners. So Globalfy was a game-changer because we were only on Amazon, and we wanted to deliver a personalized experience to American consumers, just like we do in Brazil. With Globalfy, in addition to the other services we have hired, the actual delivery itself, we are able to customize exactly what we want which is plastic-free packaging, even with the paper tape.”

Marcele Martins,

Partner and Head of International Expansion - B.O.B (Bars Over Bottles)

“We started researching and found the contents of Globalfy, explaining the whole process, how taxation works, and all that. In short, it took about two months to study, and then we set up a call with the Globalfy’s specialists, and that’s when we decided: let’s do it! Globalfy helped a lot throughout the process, demystifying this ‘monster’ of being in a totally unknown market.”

Marcel Eberle,

Entrepreneur and Founder - Marétoa

“It was something very interesting because, in a matter of 30 days, we had a meeting with Globalfy. After 60 days, we had the company ready, and the container was on board. So, it was very quick. ”

Edson Finger Júnior,

Brand Partner - Falkk

“We were able to count on the support of specialized partners who helped us take care of everything remotely. If we didn’t have this support, it would be a challenge. After all, American legislation is a topic that we don’t master.

”

Arthur Furlan,

CEO & Co-founder - Configr

MORE COMPANIES WE HELP TO GROW

A blog made for global entrepreneurs looking for rich and valuable content

Answers ready to solve your doubts

LLC stands for Limited Liability Company. This legal entity helps protect your personal finances from potential issues or lawsuits against your business while avoiding double taxation. By creating an LLC, you only need to pay taxes as an individual, not at the company level.

The C Corp is a more formal structure that follows some specific regulations such as adopting bylaws, holding frequent shareholders meetings, and issuing stocks. In addition, it is subject to state and federal taxes at the company level, plus shareholders taxation in case of profits distribution.

Choosing the State based on your preferences and the business’ particularities is essential. For example, Wyoming offers the fastest formation and is one of the most affordable states. On the other hand, Florida’s usually the favorite State for Latinos, despite being more expensive than Wyoming.

We offer LLC and Corp formations in Wyoming, Florida, Delaware, Texas and New Mexico. We are specialized on E-commerce and Online Services companies, such as D2C or B2C Brands, Dropshipping, Software, Technology, Marketing, and Digital products.